Some Known Details About Hsmb Advisory Llc

Plan advantages are lowered by any kind of superior loan or lending interest and/or withdrawals. If the policy gaps, or is given up, any type of impressive finances taken into consideration gain in the policy may be subject to regular income tax obligations.

If the policy proprietor is under 59, any type of taxable withdrawal might also be subject to a 10% government tax obligation penalty. All entire life insurance plan guarantees are subject to the prompt repayment of all required costs and the claims paying capacity of the providing insurance policy business.

The cash money surrender value, finance worth and fatality earnings payable will certainly be minimized by any lien impressive due to the payment of an increased benefit under this motorcyclist. The increased benefits in the very first year mirror deduction of a single $250 management fee, indexed at an inflation price of 3% per year to the rate of velocity.

5 Simple Techniques For Hsmb Advisory Llc

A Waiver of Costs cyclist forgoes the commitment for the policyholder to pay further costs need to she or he become totally impaired continually for at least 6 months. This cyclist will certainly sustain an added price. See plan contract for extra details and requirements.

Here are several disadvantages of life insurance policy: One disadvantage of life insurance policy is that the older you are, the extra you'll spend for a plan. This is since you're much more likely to die throughout the policy period than a more youthful insurance holder and will, subsequently, set you back the life insurance policy business even more cash.

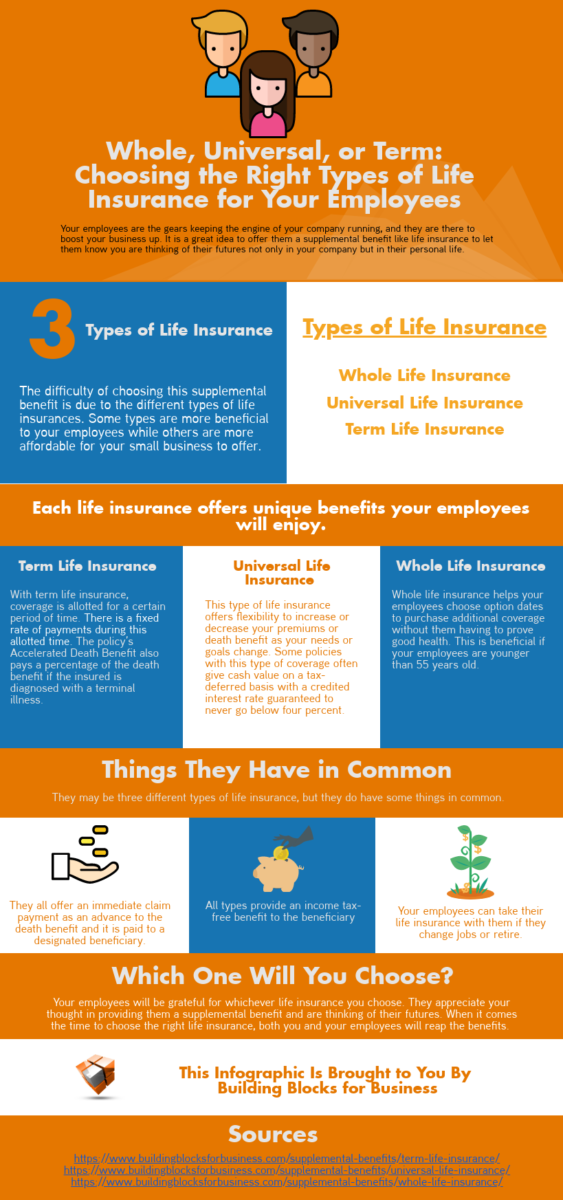

2 If you pick a long-term life policy, such as entire life insurance coverage or variable life insurance, you'll obtain lifelong insurance coverage. 2 If you're interested in life insurance, take into consideration these ideas:3 Don't wait to apply for a life insurance coverage policy.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

By making an application for life insurance protection, you'll have the ability to assist shield your liked ones and obtain some assurance. Aflac's term and entire life insurance policy policies can offer you comprehensive protection, costs that fit most budget plans, and various other benefits. If you're unsure of what type of protection you must obtain, contact a representative to review your alternatives - Insurance Advisors.

There are many potential benefits of life insurance policy however it's typically the peace of mind it can offer that matters one of the most - https://www.figma.com/file/sFtu0GAQvAmUxCv3Avokho/Untitled?type=design&node-id=0%3A1&mode=design&t=ZZZsgGIq4eLLJGr2-1. This is since a payout from life cover can work as an economic safeguard for your enjoyed ones to drop back on should you pass away while your policy is in location

The bypassing benefit to all is that it can take away at least one worry from those you care around at a tough time. Life insurance can be set up to cover a home loan, possibly helping your household to remain in their home if you were to die. A payout could assist your dependants change any kind of income deficiency really felt by the loss of your profits.

Hsmb Advisory Llc for Beginners

A payment can be used to help cover the cost of your funeral service. Life cover can assist mitigate if you have little in the method of savings. Life insurance policy products can be used as have a peek here component of estate tax preparation in order to decrease or prevent this tax. Placing a plan in trust fund can provide greater control over assets and faster payouts.

You're ideally eliminating several of the anxiety felt by those you leave. You have assurance that enjoyed ones have a certain degree of economic defense to draw on. Securing life insurance policy to cover your mortgage can give comfort your mortgage will be repaid, and your loved ones can continue living where they've always lived, if you were to die.

See This Report on Hsmb Advisory Llc

Arrearages are generally paid off making use of the worth of an estate, so if a life insurance policy payment can cover what you owe, there must be extra entrusted to pass on as an inheritance. According to Sunlife, the ordinary price of a fundamental funeral service in the UK in 2021 was just over 4,000.

Little Known Facts About Hsmb Advisory Llc.

It's a considerable sum of cash, yet one which you can offer your enjoyed ones the opportunity to cover using a life insurance coverage payout. You should talk to your carrier on information of exactly how and when payouts are made to make certain the funds can be accessed in time to pay for a funeral service.

It may additionally provide you much more control over that receives the payout, and help in reducing the possibility that the funds might be used to pay off debts, as can take place if the plan was outside of a trust fund. Some life insurance policy plans include a terminal health problem benefit option at no added expense, which could result in your plan paying early if you're diagnosed as terminally unwell.

A very early payment can allow you the possibility to get your events in order and to maximize the time you have actually left. Losing someone you love is hard sufficient to handle in itself. If you can aid ease any fears that those you leave could have concerning exactly how they'll cope financially progressing, they can concentrate on things that really need to matter at the most hard of times.